uFund,

your Tax Shelter expert

For more than 22 years, we have developed an innovative approach focused on the needs of the investor thanks to a unique positioning within the Umedia group: an alliance between financial expertise and audiovisual production.

What is Tax Shelter ?

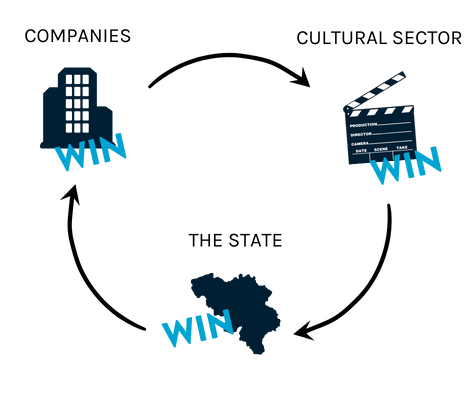

It allows any company subject to corporate tax in Belgium, under certain conditions and within certain limits, to reduce its taxes by supporting an audiovisual (film, series, documentary) or scenic (theater, ballet, opera, etc.) work.

Return*

By investing in Tax Shelter, your company optimizes its taxation through a double mechanism:

COMPLEMENTARY BONUS ON 18 MONTHS

An additional premium, calculated over a maximum period of 18 months, is added to the tax benefit. Its exact amount corresponds to 4.5% plus the Euribor rate (2,181% first semester 2026). It is calculated over a maximum period of 18 months. Currently, this additional non-actuarial return amounts to 10,02% gross of the amount invested (7,52% net)*.

TAX ADVANTAGE

The law allows a company, under certain conditions and within certain limits, to deduct 421% of the Tax Shelter investment from its taxable base for the tax year in which the framework agreement is signed. For an investment of 100 and a tax rate of 25%, the tax benefit is : 100 x 421% x 25% = 105.25. This corresponds to a 5.25% net return on the investment amount.

* By return, we mean the amounts received over the investment period, subject to receipt of the full tax certificate. The return is based on the assumption of a payment on June 30th, 2026 at the latest.

Calculate your tax savings !

Step 2

Your result

Tax Shelter result

- Amount invested:0€

- Tax Savings :0€

- Additional return (gross) :0€

- Total return (gross) :0€

- Total return (net) :0€

This simulation tool has been developed by uFund, which assumes responsibility for it. The results obtained are purely indicative.

Please consult our prospectus before making any investment decision.

Our offer

1. Due diligence and completion guarantee

2. Insurance covering the tax benefit (105.25% of the investment)*.

The alliance with expertise in audiovisual production is one of the key factors of success for your Tax Shelter investment.

* within the limits of the exclusion clauses.

** based on figures provided by the SPF Finance

Complete transparency

SPF finances Agreement

uFund is approved by the Ministry of Finance as an eligible intermediary.

Prospectus

uFund has a prospectus approved* by the FSMA on March 4th, 2025, which details the offer of uFund (for a minimum investment of € 10,000) - valid for the period from 4/03/2025 to 3/03/2026. We invite you to consult it before making any investment decision.

Contact-us

Want to know more about the opportunity to invest in Tax Shelter for your company?

A Tax Shelter consultant will contact you within 24 hours.